This time is not different

Notes on how you can tell you're close to the top.

All my (limited) years of working, have been broadly in “tech” and crypto. One similarity they have, is that they expose the cyclical nature of things to you. You mostly clearly see and feel the ups (euphoria, frenzy, funding) and the downs (stress, layoffs, dejection). Over time trends go up and come down and up and down and repeat. You may trend upwards or downwards overall, but you keep feeling cycles within those trends too.

But what happens in these cycles?

At the bottom you feel like its all fake, a scam and you’re a victim who got played by everyone around you. At the top you feel like this is it, its going to change the world, the future and also your net worth.

Both times times whatever you feel there will be some truth to it, and both of the times the opposite will also be true too. At the top and at the bottom the emotions are the easiest and there is high clarity (even if wrong). What’s hard to navigate is the movement upwards or downwards. Everyone acts in funny ways, cope and make things blurry, so you need to develop heuristics to be able to tell what’s happening.

I’ve seen a few of these cycles:

First in Q4 of 2017, I was a mostly broke law student interning as a researcher in an investments company. From the sidelines, with barely any money to my name, I got very involved and saw what happens when BTC went from $4K to $20K and back in just a few months. Students, companies and even my tea stall owner’s son in suburban New Delhi, who she otherwise usually described as good-for-nothing-drunk was interested in BTC. Which gave me: Rule1. when even broke college kids and people with no money to their name are investing all their money into something, its very close to the top.

Second time, in 2020-21 when BOTH tech (private) & tech (public), and crypto rallied up from March 2020 non-stop till November 2021. Most tech adjacent sectors (fintech, crypto, edTech, media) were in some sort of frenzy at the time.

Third time (which was also in some ways the first way) was when I was a 3 year old. Our family used to live in the Bay Area at the time. Both my parents were engineers who found themselves in the middle of the Dotcom bubble. Them and everyone they knew saw their net worth 10x and go back down in a few months time. At the peak in 2000, I was 3 years old, I’ve been told I used to refer to myself as Neildotcom. My mom Akruti as mummadotcom and my dad Samir as samirdotcom. Which brings me to Rule2. When actual illiterate toddlers are plugged into the current thing, get out immediately.

My language about trends is heavily influenced by the lens of startups, public markets and crypto: “cycles”, “the top”, “bull market”, “bear market”, and “sell signal”. But these trend cycles of ups & downs and tops & bottoms isn’t limited to these markets. Everything has a trend cycle if you look closely enough — COVID, Trump-Modi-End-of-democracy-politics, fashion, MeToo, The All In Podcast, BLM, Sadhguru, Jordan Peterson, most things seem to have a cycle. When we don’t see signs of the cycle, very often its just a very long cycle we’re not yet trained to notice and spot well.

This is not an essay, its my attempt at a Buzzfeed-esque comedic listicle. A list of rules that help you figure out how close are you are to the top.

They say time in market is more important than timing the market, and timing the market is notoriously hard. But that will not stop most of you from trying, it’s probably also rational if you find yourself in a situation like this, especially if you work or deal with anything that is hyper cyclical. These heuristics might not (mostly likely will not) make you rich but at the least it will help you make a few decisions with more clarity. So if you’re going to try to buy low, sell the top and buy again (lol) anyway, these are some heuristics I wish I knew earlier. Happy reading.

None of this is financial advice, neither for the time this is written (March 2024), or about any time in the past or any thing regarding the future at whichever time you’re reading this. This is just a list of observations and personal heuristics and triggers that I wish I knew earlier. This may be sociological advice. It might help you understand how crazy the world sometime starts acting and how it could make doing the something very hard for you to do something even when you know its right.

What are the signs?

The short answer is that as you get closer to the top — everyone is interested, its the solution to all of the worlds problems, and so there is unlimited money, time, scope and discussion regarding it.

You’re suddenly the wunderkind of the family and the secret genius amongst your friends.

Friends and family who last showed interest in you and your life many years ago, but know vaguely that you work in X, will reappear into your lives with an interest in your work, and they’ll say some version of the following:

“Ah you’re so lucky”

“I myself have been dabbling in X recently, would love to know more about it from you”

“I always thought you made the right choice”

“My cousin/son has also always been interested in X, please help him chart a career path”

You literally cannot escape conversation about it.

As you get close to the top, you will not be able to go for a few minutes at a time without seeing content or being pulled into a discussion about it.

You open Twitter its there, you turn on the news it theres, your parents text you about it, you meet your friends they’re talking about it, you go to a party everyone sobers up by talking about it. No escape.

General parties are the clearest sign. If you go to a party with diverse enough crowd, e.g. school friends, where everyone is doing different things now, and even there this unexpected group burst into conversation about something unusual, thats when basically all of society is engulfed by it.

There was no house party in 2016-17 where the end of democracy and Modi and Trump weren’t discussed. That was the top of politics for the decade, and only January 6, 2021 even came remotely close.

Trendy lawyers with fancy website will start talking about it on your feeds

Lawyers will start writing reports and scholarly articles about something that sounds adjacent and to important to the current thing. They will feel they missed out on a practice area and will start signalling that they’re up to date and experts.

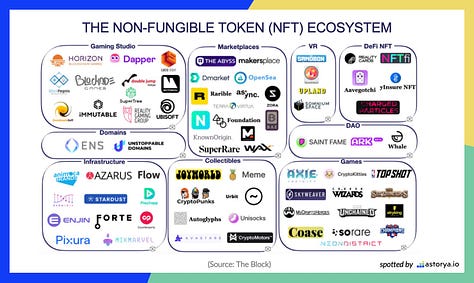

As an insider it might seem completely useless to you but you’re not the audience. In the last 4 years, I have seen law firm articles about property law in the metaverse, NFT regulations, how NFTs will change the legal industry, etc.

Law firms always find a way into the current thing

Infographics... infographics everywhere

Consultants and investors will write industry landscape reports, ecosystem deep-dives and make infographics with three hundred company logos on it.

Other useless articles also might similarly follow.

Infographics galore the best time to start a defense startup was when mentioning that you were working with the military would get you socially ostracized and banned from ivy league’s campus from recruiting. the worst time is when VCs start making “market maps” for defense tech. —@lastcontrarian, here

The trend-branded grifting experts emerge

Consultants, lawyer and accountants will emerge who will brand themselves as X-Lawyers, X-Consultants and experts.

Specialization is good but more often than not they will be using it to signal expertise where there is none and get money from unsuspecting others who are raising money left right and centre.

Sidenote: When in doubt: a good general corporate lawyer is almost always better than someone who self-identifies as a something-specialist-lawyer.

Someone who calls themselves a Metaverse Lawyer generally doesn’t know much about either the metaverse or the law.

Massive insane giga ad spend at sports events

The total share of ads and sponsorships your industry’s has at the years biggest events are reaching absurd levels.

The easiest signals are Super Bowl half time ads, IPL and Cricket World Cup Sponsorships, Indian Cricket Team jersey sponsorships and F1 sponsorships.

All these are probably some of the highest eyeball events and have extremely expensive slots. So if many companies including many mid ones start thinking its valuable spend, you’re in some kind of frenzy.

IFYKY

Envy from others is a good sign, but their support is the worst sign.

On your way up, lots of easy money will be made by lots of people. Which will generate a lot of envy and cope from those that missed out. This is mostly a good sign, if you have no haters, you’re not doing anything right.

But as you get closer to the top of completely euphoria, even the worst of skeptics will start falling and start publicly espousing your cause. Thats a sign, beware.

Fancy MBAs are reaching out to you for jobs

This is an old Peter Thiel adage, but if you see lots of people from fancy MBA colleges suddenly wanting a job in your industry you might be nearing the top.

If you’re not in consulting, banking or PE, the ideal number of people you want aspiring to be your colleague is probably like ~5%.

When an MBA friend says they have classmates very interested in your field, their voice needs to tell that they think those people are nuts, thats a good sign.

If they say something like “Oh I just got into a class on Entrepreneurship and AI”, or that everyone is looking for a job in crypto, that means your time is up.

“The largest cohorts from MBA systematically ends up doing the wrong thing; catching the last wave. 1989 everyone wanted to work for Mike Milken, 2 years before he went to jail for junk bonds; they were never interested in SV or tech except for 1999-2000 where they caught the dotcom bubble peaking perfectly, 07-08 was housing.”

Governments mostly leave most trends alone, except two specific moments in time:

(a) when the bubble bursts they start coming in wanting to regulator and protect consumer interests, and (b) close to the peak of the bubble they’ll want to start government schemes and programs to fund and support innovation in it.

Nobody in India cared about crypto except for (a) blockchain use cases in public good during the top, and (b) ban everything and tax it all post the crash.

If you start seeing your relevant minister / secretary more often than you think otherwise the general hierarchy would dictate, that means they’re getting too excited and the top is near.

Meta-monetization: When there’s paid courses on how to make money doing the current thing

There’s a big part of the internet, mainly on Youtube, Instagram Ads and Twitter Threads which focus on self improvement, making more money, very often in the form of “Passive Income”, which is mostly a polite way of saying “Do nothing and make money” or “Free Money”.

In a frenzy there usually seems to be financial laxity, lots of funding and lots of leakages, so its true that it’ll seem like everyone can get some if they do something here and there.

These are usually industry secrets, when these things reached hustle pornstars and starts feature in passive income content, thats a bad sign.

The post-economic kings and queens arise from the ashes.

Celebrities, billionaires and already successful rich people generally have high opportunity cost and their time is expensive, so they don’t get involved much with things outside their main thing.

These types of people are not always on the lookout for the next big they’re, so they relatively late to the party and most times too late.

When you make big headlines or cross top milestones, even they will give in and want to know whats happening. You’ll one day suddenly see them tweeting about “how something interesting is happening and they want to know more” or “looking to invest more time and money”, thats also a bad sign.

Great read